How Our Transactional Funding Loans Work For You:

- Get a Proof of Funds Letter in hours

- Close in days, not weeks

- Financing up to $10 million

- A dedicated specialist for all your needs

- Free, no-obligation loan underwritings

It all starts with a free, no-obligation consultation with your loan officer!

Transactional Funding From Washington Capital Partners:

You don’t have time to wait around for a slow lender to provide you with a Proof of Funds letter, you need a hard money lender that can move just as fast as you. Speed isn’t our only specialty, we also know you demand excellent service from the lenders you choose to work with. Our team is 100% in-house and is highly trained to avoid the common miscommunications between wholesalers and lenders and cut to the chase.

To maximize the value that we can bring to the table we’ll not only fund your wholesale contracts, but we’ll help you find an end-buyer by marketing your property on our partner company, Off-Market Deals HQ. We will also use our email alert system of over 8,000 confirmed investor recipients to blast your property to ready and willing end buyers.

If you’re ready to work with a lender to create a seamless system of funding and marketing your deals, we’re ready to earn your business. Use the quick form below for a free, no-commitment consultation with one of our lending experts:

"*" indicates required fields

Questions and Answers About Transactional Funding Loans:

What is a Transactional Funding Loan?

This option finances a back-to-back (simultaneous) closing. With these funds, a wholesaler can purchase a property from a seller and assign the contract to an end buyer; typically within 1-5 business days, making the process fast and easy. Because everything is time sensitive, many people use private lenders since large institutions cannot normally close the deal fast enough.

How Many Parties are Involved?

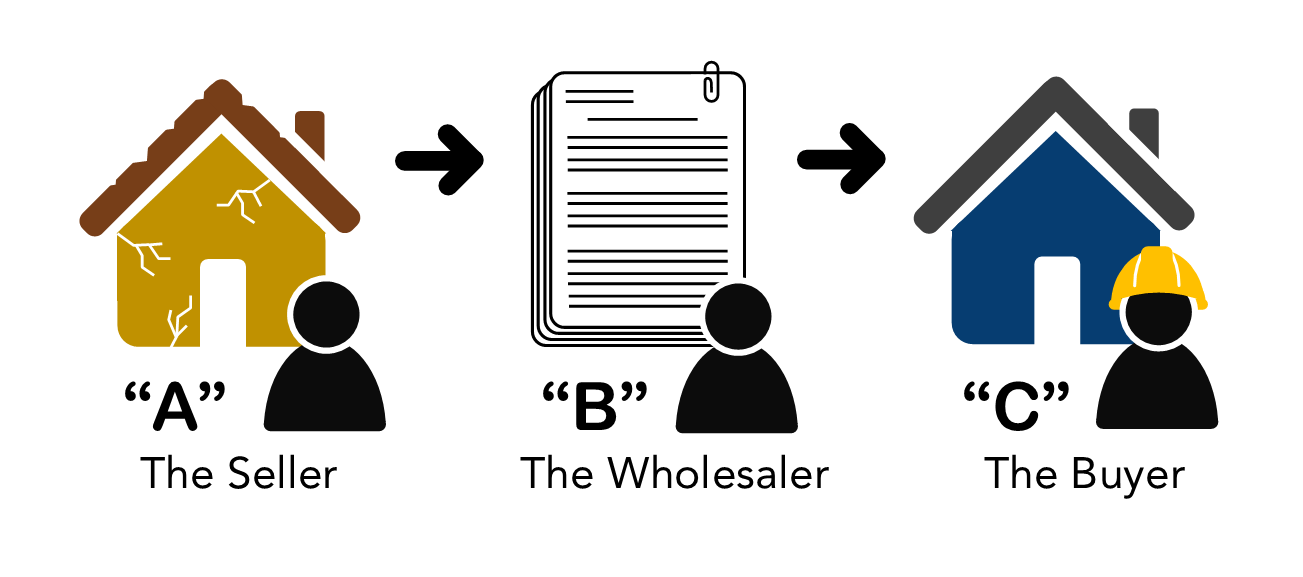

This involves three individuals:

- Motivated Seller – “A”

- Wholesaler – “B”

- End Buyer/Investor – “C”

How are they used?

Once the wholesaler “B” has a motivated seller “A” and a prospective buyer “C,” “B” can either use cash to purchase the property from “A,” and assign the property from ”A,” and assign the purchase to “C,” or seek out transactional funding from a hard money lender.

“A” will sell a property to “B” (A-B Closing) and “B” sells to “C” (B-C Closing).

What do I need to be eligible?

To be eligible you need to have 3 things:

- A motivated seller

- A business entity, such as an LLC/Inc.

- An end-buyer who must be ready to close immediately. The title company must send written confirmation that the cash is in their escrow account.

With all 3 of these items ready to go upon contacting us, your dedicated loan specialist will be able to facilitate an underwriting faster and increase the chances of getting your loan funded quickly.

Is a Proof of Funds (POF) Letter provided by the lender?

Yes. Your lender will provide a POF letter to your seller to prove that you have the funds to purchase the property. This document gives you official backing by an established/official financial institution.

Are there any upfront fees?

The borrower will pay an Origination Fee (percentage points of the loan amount) for the loan. Unlike a Fix and Flip Loan that requires you to pay both an Origination Fee and bring a large down payment, no down payment is needed to be a wholesaler. This is why wholesaling great way for you to get your start in real estate investing with minimal costs.

Is there a processing fee?

Yes. At closing, you will be charged a processing fee of $1,000. This is separate from the Origination Fee. This fee covers the cost for a lawyer to review all documents and certify that the property and title meet all legal criteria needed to close.